Stocks and Mutual FundsStocks and Mutual Funds

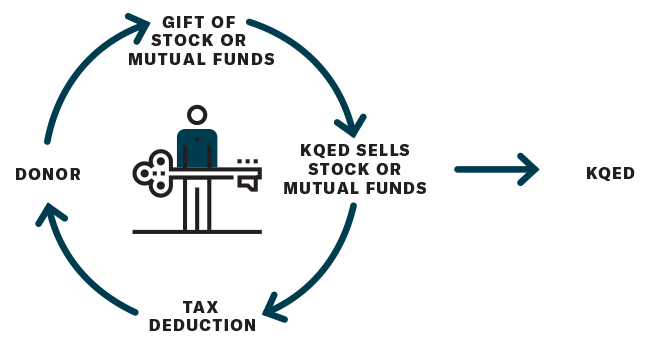

Using appreciated stock or mutual funds is a tax-wise way to fund your gift to KQED. Gifts of appreciated securities held longer than one year are exempt from capital gains taxes and for outright gifts entitle the donor to a tax deduction equal to the fair market value of the securities at the time of transfer.

To avoid exposure to capital gain tax, the stock must be transferred to KQED. We then sell the stock from our account.

Membership gifts

To make a current gift of stock, please give your broker the following instructions for electronic delivery to KQED.

Deliver to DTC 0164

Account number: 5218-5436

Account name: KQED Inc.

KQED’s broker:

Charles Schwab & Co, Inc.

101 Montgomery Street

San Francisco, CA 94104

Please contact us at (415) 553-2300 or majorgifts@kqed.org to notify us of the transfer details as stock transfers to KQED arrive without any membership or contact information and we would like to properly credit your gift and provide you with a letter for tax purposes.

Legacy Gifts

Stock and mutual funds may also be used to fund charitable gift annuities and charitable remainder trusts. Please complete our request for information form.